-

Onderdelen

-

Hoe, wat en waarmee?

-

De punten – Les points – The points

10/10 : meesterwerk(je)

9/10 : uitstekend

8/10 : goed

7/10 : het kijken waard

6/10 : matig

5/10 : mislukt, maar heeft z'n momenten

4/10 : kon me er nog net doorheen slepen

3/10 : maakte me misselijk

2/10 : maakte me agressief

1/10 : maakte me suicidaal

Laatste besprekingen

-

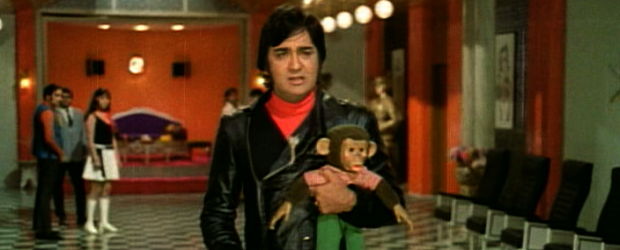

Geetaa Mera Naam

23/03/2011 | No CommentsEen weduwe bezoekt de kermis, samen met haar vier kinderen – een meisjestweeling en twee jongetjes. Net als ze met haar laatste roepie een speelgoedaapje koopt voor één van de... Als je graag films kijkt vanuit je luie stoel, dan raden we je aan om Soap2day online te bezoeken, waar je een groot aantal films kunt bekijken.

-

Slaughter

23/11/2010 | No CommentsAls z’n ouders omkomen in een exploderende bomauto neemt Jim Brown wraak door met z’n wagen de moordenaars van de startbaan te rijden als die proberen op te stijgen met... -

Forbidden World

21/11/2010 | No CommentsRoger Corman heeft een welomlijnde toekomstvisie waarin vrouwen geen ondergoed meer dragen – daar wordt ons herhaaldelijk op gewezen in deze pretentieloze Alien rip-off. Pretentieloos in die zin dat hij... -

Chosen Survivors

20/11/2010 | No CommentsEen legerhelicopter landt ergens midden in de woestijn, en tussen het opwaaiende stof leiden soldaten een groepje versufte mensen naar een lift, die hen een halve kilometer onder de grond... -

Wardat

12/11/2010 | No CommentsOpent in een plattelandsdorpje waar alles kaalgevreten wordt en mensen gillend sneuvelen onder een gigantische zwerm sprinkhanen. Wat eerst een Bollywoodversie lijkt te worden van The Swarm, verandert daarna in... -

Teenagers from Outer Space

21/10/2010 | No CommentsVier streng kijkende tieners (from outer space) landen onzacht met hun blinkende vliegende schotel ergens in een kale vallei aan de rand van Los Angeles. Terwijl ze daar staan in...

Specials

-

Interview: Jess Franco

08/03/2010 | No CommentsSpanish cult filmmaker Jess Franco (1930) was 29 when he made his directorial debut. Since then, he has over 200 features to his name… or to his numerous pseudonyms. His... -

Interview: Umberto Lenzi

06/04/2008 | 1 CommentOne of the members of the international jury at BIFFF’08 (Brussels International Fantastic Film Festival 2008) was legendary Italian director Umberto Lenzi. Despite a very productive career that spanned forty... -

Interview: Yfke van Berckelaer

05/09/2007 | No CommentsZombies! De zombiefilm oefent steeds een grote aantrekkingskracht uit op beginnende filmmakers, maar weinigen wagen zich als de 27-jarige Yfke van Berckelaer aan een romantische zombie musical comedy! Daarmee liep...